How to enter an item expense

The Office expense is an “Indirect” cost. These include administrative costs such as overhead, salary, insurance premiums, advertising, rent, telephone, etc. They also include things like depreciation on equipment, repairs to equipment, and labor burden. They are the costs incurred by your business which cannot be linked to one specific project.

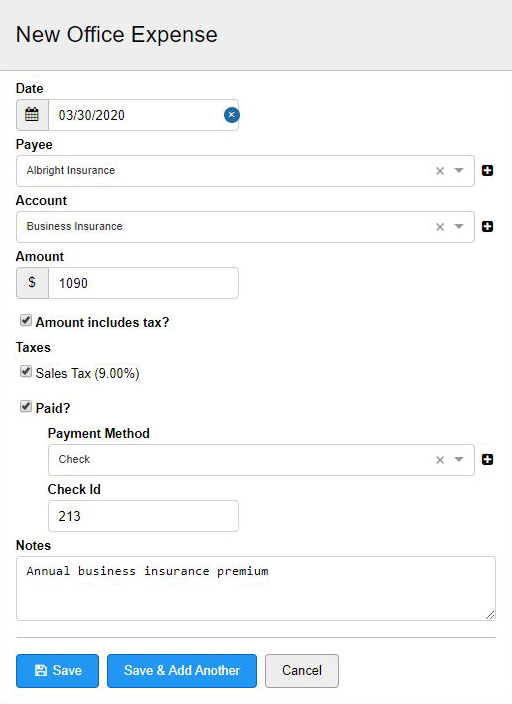

To enter an Office expense – or Indirect cost:

- Navigate to the Item Expense window.

- Select the New Office Expense tab.

- Enter a date the expense was made.

- Choose from a list of available Vendors (Payees).

- Choose an Expense account.

- Enter the amount of the expense.

- Check the “Amount Includes Tax” box if the amount entered includes tax.

- Select the applicable taxes.

- Record the method of payment.

- Add any notes about the expense.

- Save the Office expense.

The Project expense is a “Direct” cost, which gets recorded to the Balance Sheet. These costs can be traced to specific projects. They include the cost of labor, materials, equipment, subcontractors, rentals and other directly related costs required to complete a particular project. Because these activities are easily traced, their costs are usually charged to projects on an item-by-item basis.

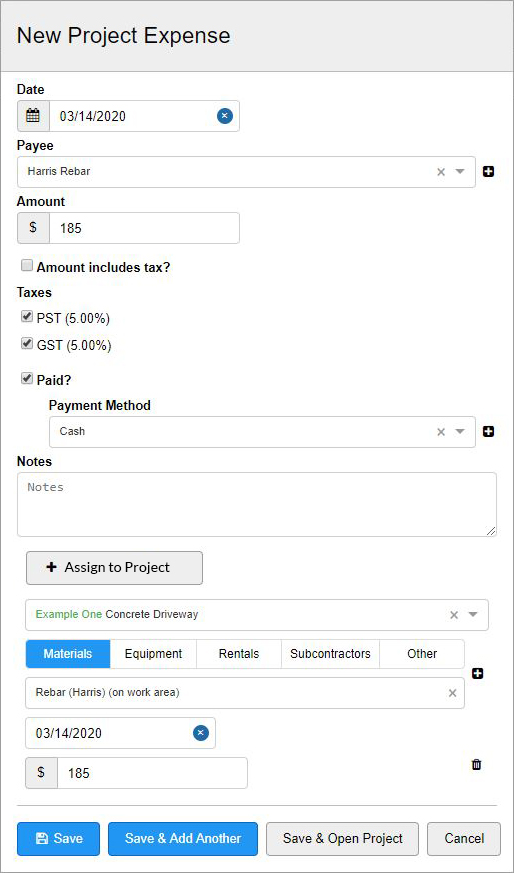

Entering a Project expense – or Direct cost – is a two step process.

Step two assigns the project expense to a project work area. To do this you must first identify the project and work items from the project that you would like the expense amount to correlate. You do this by selecting work items from the Item catalog that match with work items in the project. Why is this necessary? When you assign a project expense to an actual project, you display actual work item costs with estimated work item costs. This cost comparison is viewed in the project layout window so you can see how much your spending on each work item and whether you are on, under or over budget. This job costing information helps you to make informed, educated decisions on the financial health of your project.